Investing in insurance is a proactive step that can safeguard your financial future and well-being.

Investing in insurance is a proactive step that can safeguard your financial future and well-being. Overall, insurance is a crucial tool for managing risk and providing financial protection in uncertain times.

Buying insurance serves several important purposes:

-

Financial Protection: Insurance helps protect you from potential financial losses due to unexpected events, such as accidents, illnesses, natural disasters, or theft.

-

Risk Management: It allows individuals and businesses to manage risk by transferring the burden of potential financial loss to the insurance company.

-

Peace of Mind: Having insurance provides peace of mind, knowing that you have a safety net in place should something unfortunate occur.

-

Legal Requirements: Many forms of insurance, such as auto insurance, are legally required in certain jurisdictions, making it necessary for compliance.

-

Healthcare Access: Health insurance ensures access to necessary medical care without incurring prohibitive costs out of pocket.

-

Business Continuity: For businesses, insurance can ensure continuity in the face of disruptions, covering things like liability claims or damage to property.

-

Investment Opportunities: Certain types of insurance, like whole life policies, can also serve as investment vehicles that accumulate cash value over time.

Investing in insurance is a proactive step that can safeguard your financial future and well-being.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

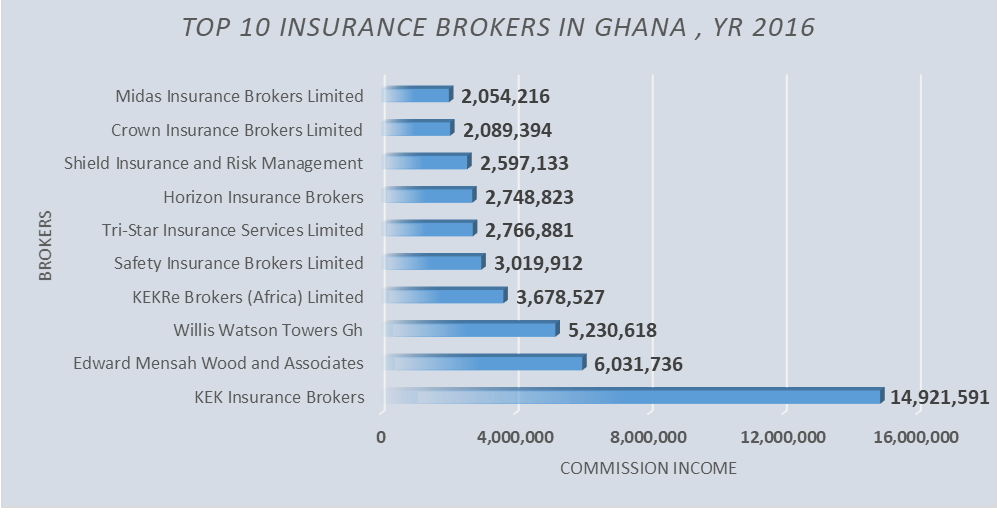

KEK insurance brokers likely to retain highest market share over a long period of time: Star CEO

Professional indemnity policy and premium computation

KEK Insurance Brokers celebrates 35 years of excellence in broking business

Reduce prices of goods as cedi strengthens – Finance Minister appeals to traders

Enterprise Life launches “Pharma Care Group Life ‘’ for Pharmacy staff

Investing in insurance is a proactive step that can safeguard your financial future and well-being.

InsureTech

Technology