Five (5) Reasons Why You Need a Homeowners Insurance Policy

Homeowners insurance is a form of property insurance that covers losses and damages to your residence, along with furnishings and other assets in the home. Homeowners insurance also provides liability coverage against accidents in the home or on the property.

In Ghana, where unpredictable events like floods, fires, and burglaries are a reality, home insurance has become a necessity. It is your shield against the unexpected, ensuring your peace of mind and financial security in the face of disaster. Below are Five (5) reasons why you should consider buying homeowners insurance

- Peace of Mind: Imagine waking up to a fire or finding your home flooded. The fear and uncertainty can be overwhelming. With home insurance, you have one less thing to worry about. Knowing your home and belongings are protected gives you the peace of mind to focus on recovery and rebuilding.

- Financial Protection: From fire damage to theft, major incidents can leave you facing hefty repair bills. Home insurance acts as your financial safety net. It covers the cost of repairs, rebuilding, or replacing your belongings, saving you from financial hardship.

- Protecting Your Valuables: Ghanaians cherish their possessions, and losing them to theft or damage can be devastating. Home insurance provides coverage for theft and burglary, giving you peace of mind knowing your valuables are insured.

- Comprehensive Coverage: Beyond the structure of your home, many insurance policies offer additional coverage for personal belongings, furniture, and even legal fees if someone is injured as result of using your property. This comprehensive protection ensures you are covered against various unforeseen circumstances.

- A Mortgage Necessity: Owning a home often involves a mortgage, and most lenders in Ghana require borrowers to have home insurance. This protects the lender’s investment in case of damage to the property.

Investing in home insurance is an investment in your future. It is an essential step towards securing your financial well-being and ensuring peace of mind for yourself and loved ones. Do not wait until disaster strikes. Talk to a reputable insurance provider today and explore the various home insurance plans available to find the one that best meets your needs and budget. Protect your Ghanaian home, your sanctuary, and your peace of mind.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

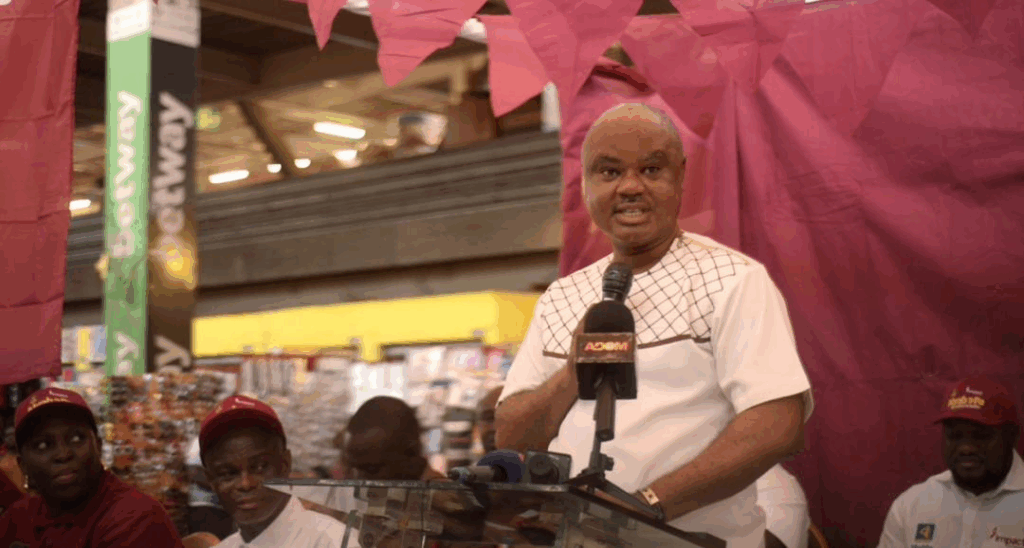

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology