CSA has sounded the alarm about insider threats in the insurance sector

Ghana has made a notable leap in global rankings for social media use in work activities, climbing from 21st to 7th place as of January 2024. This advancement, however, comes with heightened cybersecurity risks. Experts warn that cybercrime is set to soar to $9.22 trillion by the end of this year, with projections reaching $13.82 trillion by 2028.

These alarming figures were disclosed on Tuesday, July 30, 2024, during a crucial briefing on cybersecurity awareness at the National Insurance Commission Auditorium. The session, organised by the Cyber Security Authority (CSA) in collaboration with the Insurance Brokers Association of Ghana (IBAG), provided essential training for over 75 members, underscoring the urgent need for enhanced cybersecurity measures.

Ms. Patricia Adafienu, an officer at the CSA, highlighted the pressing need to address insider threats within the insurance sector. "The risk of information leaks due to disgruntled employees is significant," she stated. "We must implement robust checks and balances to address these risks and protect against denial-of-service attacks, which can lead to hackers cloning websites and compromising client data."

Mr. Eric Kafui Bansah, also from the CSA, reinforced the call for heightened cybersecurity awareness. “As our world becomes more digital, the risk of cybercrime grows, it is thus imperative that we enhance our cybersecurity practices to safeguard against emerging threats.”

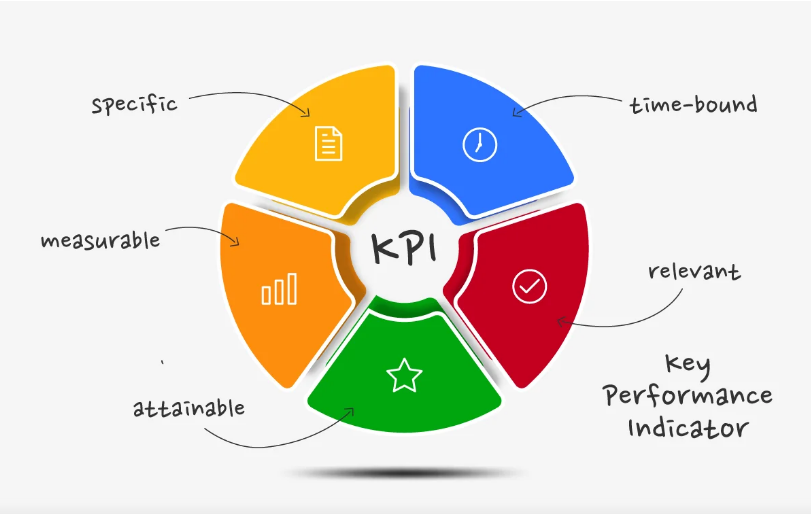

The training session addressed practical measures to protect key information systems within the insurance industry. Participants were advised on best practices, such as installing security software on mobile devices, avoiding public Wi-Fi, regularly backing up data, updating devices, and using strong passwords.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

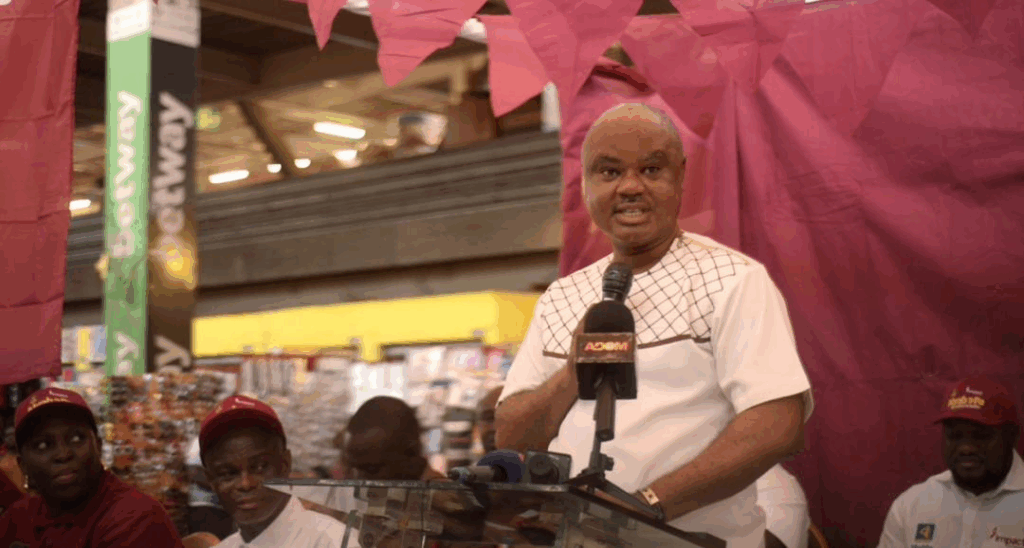

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology