How to Ensure Your Family’s Financial Security with Individual Life Insurance

Individual life insurance is one of the most effective ways to safeguard your family's financial future in the event of your death. It provides a financial cushion that can help replace lost income, pay off debts, and cover living expenses. While it may not ease the emotional toll of losing a loved one, life insurance ensures that your family isn’t burdened with financial hardship during a challenging time. By securing life insurance, you’re giving your loved ones the ability to maintain their standard of living, pay for essential needs, and preserve long-term financial goals.

The benefits of life insurance extend beyond income replacement. It can help cover mortgage payments, student loans, and other significant debts, so your family isn’t left grappling with financial obligations. Additionally, life insurance can provide funds for your children’s education or ensure that your spouse has the financial resources to retire comfortably. In essence, life insurance gives your family the time and financial space to grieve and adjust without the immediate pressure of making ends meet.

When selecting a life insurance policy, it's important to consider several factors, including the coverage amount, type of policy (such as term life or permanent life insurance), and premiums. The coverage amount should reflect your family’s needs, factoring in lost income, outstanding debts, and future expenses. Term life insurance offers affordable coverage for a set period, while permanent life insurance offers lifelong coverage with the added benefit of building cash value. It's crucial to choose a policy that aligns with your budget while ensuring sufficient protection for your family’s financial security.

At miLife Insurance, we are committed to helping you find the right life insurance policy for your needs. Our team of experts is ready to guide you through the process, offering personalized advice and support to ensure your family’s financial future is protected. Don’t wait for the unexpected—take the step today to secure your family’s well-being with individual life insurance.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

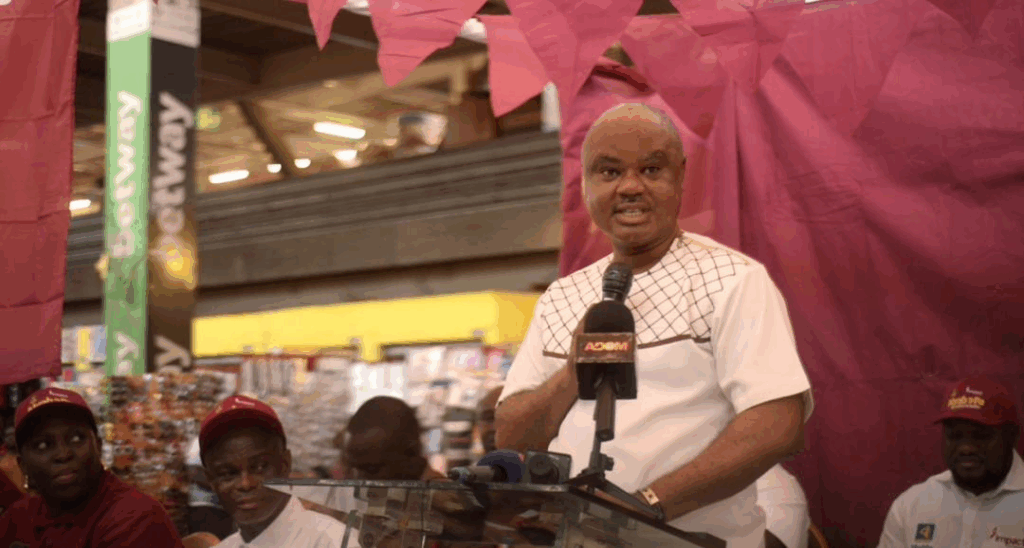

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology