Cosmopolitan Health Insurance pays 98% of claims and revolutionises healthcare coverage

In a remarkable moment for Ghana's Insurance Industry, Cosmopolitan Health Insurance has announced the launch of two transformative initiatives that will redefine the healthcare landscape.

The initiative includes international evacuation, Health Care Coverage: a safety net for Members during health emergencies, and User-Friendly Digital Portals: a streamlined Healthcare Management HR Portal.

The company has been a trusted partner for businesses seeking quality health coverage for over 11 years with its sole mission to provide innovative, customer-centric health insurance solutions that meet the evolving needs of their members and industry peers alike.

Cosmopolitan Health Insurance, a pioneering private commercial health insurer, has a robust presence in all regions, and the two transformative initiatives that will redefine the healthcare spaces are explained below;

- In-country Health Care Coverage: A Safety Net for Members during life-threatening emergencies.

- Emergency Evacuation Coverage: Members have the option to receive prompt medical attention in emergencies, with coverage for evacuation to the nearest suitable medical facility.

- Major Disease Benefit and Critical Care: A comprehensive benefit covering critical illnesses, including oncology (cancer), dialysis, and other life-threatening conditions, ensuring members receive timely and quality medical care.

- Benefits of International Health Care Coverage:

Meeting global demands and Protection: Members can travel with confidence, knowing they're protected against unexpected medical emergencies.

Financial Security: Coverage for major diseases provides financial protection, reducing the burden of expensive medical treatments.

Access to Quality Care: Members can access world-class medical facilities and specialists, ensuring the best possible outcomes.

User-Friendly Digital Portals: Streamlining Healthcare Management HR Portal: A Dedicated portal for corporate clients to efficiently manage employee benefits, submit claims, and track policy details.

InsMember Self-Portal: A user-friendly platform for members to manage their policies, submit claims, track claim status, and access policy documents.

Benefits of Digital Portals

Convenience: Members and HR representatives can access policy information and perform tasks at their convenience.

Efficiency: Streamlined processes reduced administrative burdens, enabling faster claims settlement and improved customer satisfaction.

Transparency: Members can track claim status and policy details in real-time, ensuring transparency and peace of mind.

Cosmopolitan Health Insurance is committed to settling claims promptly and efficiently. With a claims payment ratio of 98%. Members can trust that they'll receive the benefits they're entitled to.

Major Disease Benefit:

Comprehensive Coverage

The Major Disease Benefit covers a range of critical illnesses, including:

- Oncology (Cancer): Coverage for cancer diagnosis, treatment, and management.

- Cardiovascular Diseases: Coverage for heart-related conditions, including heart attacks, strokes, and other cardiovascular diseases, observing all terms and conditions.

- Mental and physical well-being:

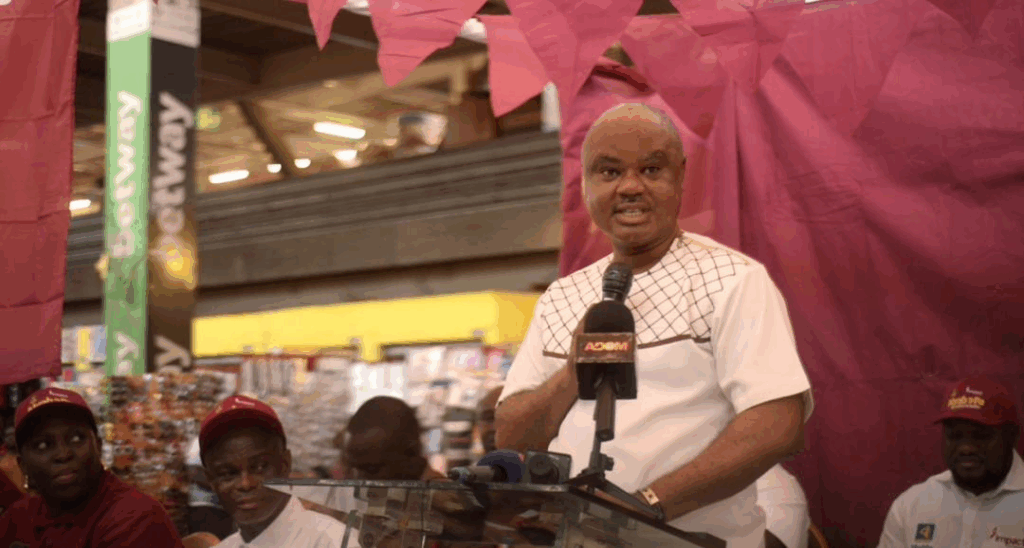

Speaking to the media during a briefing, the Managing Director of Cosmopolitan Health Insurance, Dr Setsoafia-Tukpeyi Godwin Kojo Fafali, said, these ground-breaking initiatives demonstrate Cosmopolitan Health Insurance's dedication to innovation, customer satisfaction, and comprehensive coverage.

According to him, "These initiatives, we are empowering our members to take control of their health while we provide financial protection, and ensuring access to quality medical care", he noted.

Cosmopolitan Health Insurance has positioned itself as a leading company in the health insurance industry with credibility and reputation, and also sets benchmarks, being the number one health insurance destination.

Source: myjoyonline.com

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

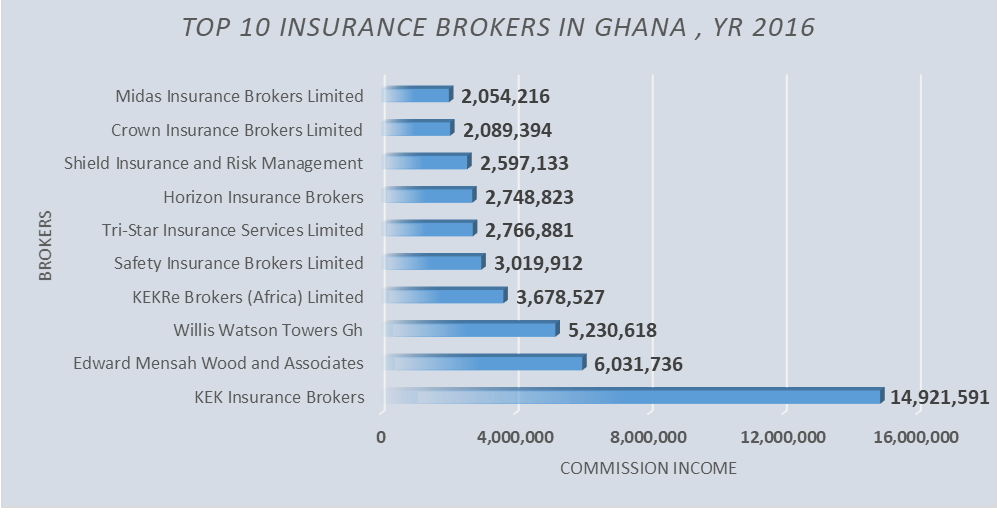

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology