Chubb Confirmed As Lead Insurer For Ethiopian Airlines Crash, WTW As Broker

Reports have confirmed that Chubb was the lead underwriter on the account for the Ethiopian Airlines jet that crashed on 10 March, while Willis Towers Watson (WTW) acted as the insurance broker.A WTW spokeswoman revealed that Chubb and WTW would be liable for losses resulting from the crash, which are speculated to be in the region of $50-60 million.Ethiopian Airlines flight ET302 crashed shortly after take-off from Addis Ababa yesterday, killing all 157 passengers on board.Reports suggest that the plane’s vertical speed was unstable after take-off and that the pilot had experienced difficulties and asked to return to the capital’s airport.While the cause of the disaster is not yet clear, an automated anti-stall system on the aircraft – a newly commissioned Boeing 737 Max 8 – has come under scrutiny.The crash was the second in five months to involve a 737 Max 8, following the Lion Air incident in Indonesia last year, which killed 189 people.“It’s highly suspicious,” Mary Schiavo, former Inspector General of the US Transportation Department, told CNN.“Here we have a brand-new aircraft that’s gone down twice in a year. That rings alarm bells in the aviation industry, because that just doesn’t happen.”Boeing is expected to release a software patch to deal with potential issues in the aircraft’s system, according to reports from Reuters, and several airlines have grounded the model in the meantime.Aviation experts discussing the crash on social networks seem to suggest in the majority that this may be a related issue to the Lion Air incident.Should it be found that a fault in the aircraft design is to blame there may be other insurance claims to be paid by Boeing, should it become the target of compensation efforts.Reuters has also reported that Marsh is the broker for Boeing’s insurance and that British insurer Global Aerospace is the lead carrier for Boeing’s policy and also for Lion Air.Source: https://www.reinsurancene.ws/chubb-confirmed-as-lead-insurer-for-ethiopian-airlines-crash-wtw-as-bro...Author: Matt Sheehan

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

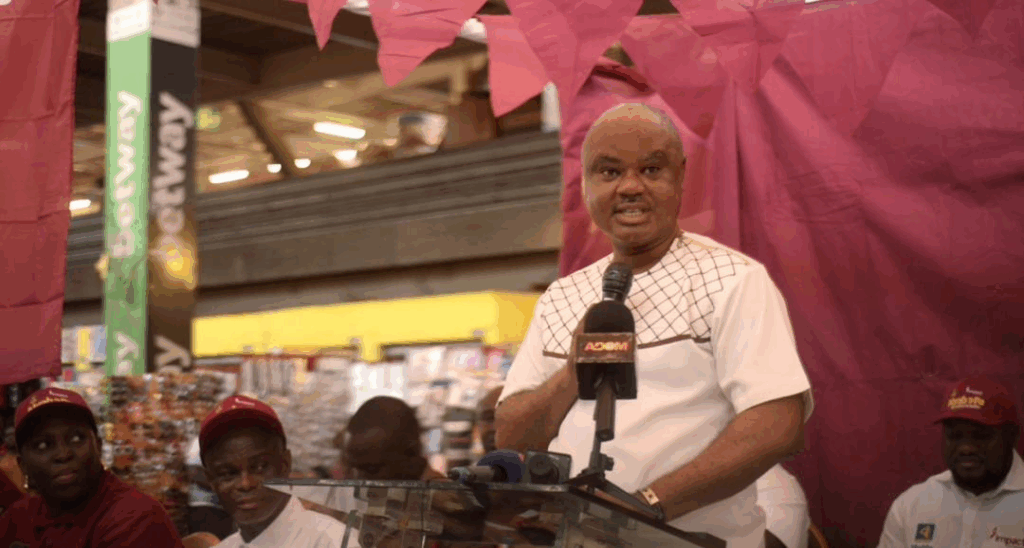

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology